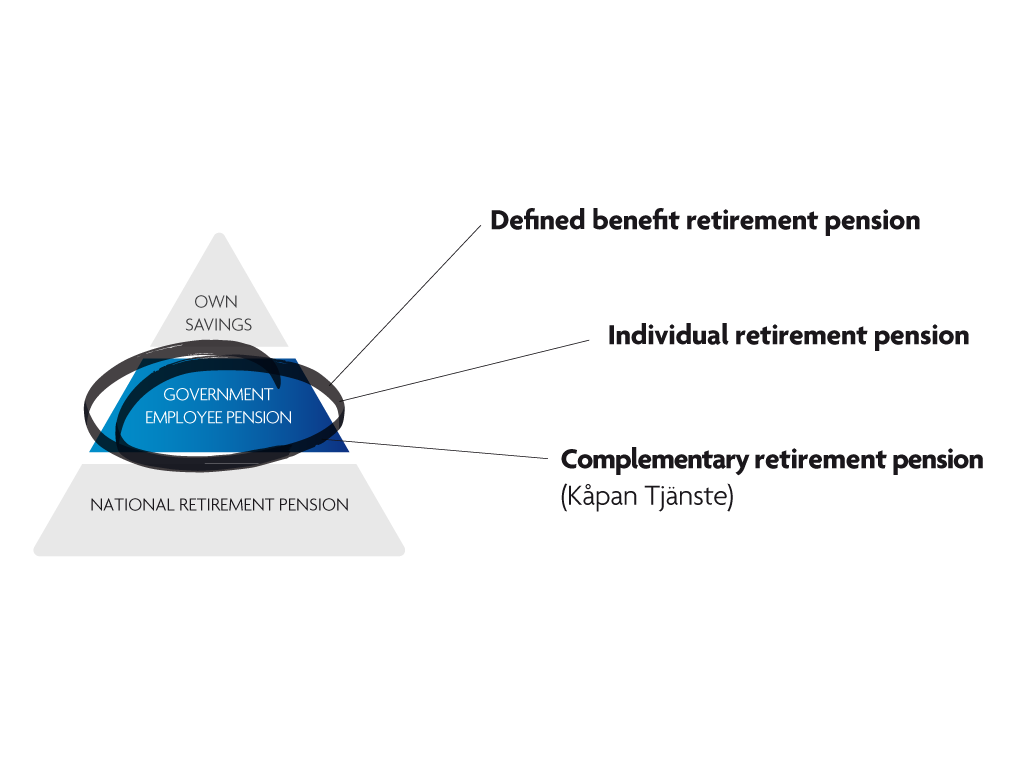

The government employee pension includes a defined benefit pension, a complementary retirement pension (Kåpan Tjänste) and an individual retirement pension. Not all government employees have all three parts, and the parts' functions are a little different.

The three parts of your government employee pension are:

Defined benefit retirement pension

The size of the defined benefit retirement pension depends upon your salary, how many years you have been employed and the year you were born. You will receive a defined benefit pension if you were born before 1973 or have a salary that is above 7.5 income base rate. You cannot begin to draw your defined benefit pension earlier than when you are 61 years. There is no upper limit.

Complementary retirement pension (Kåpan Tjänste)

Every month, your employer pays into a sum equivalent to 2 percent of your salary into a complementary retirement pension fund. It is managed by Kåpan Pensioner in a traditional insurance scheme. You can select repayment cover on this part, in which case the money will go to your spouse, partner or children if you die. Kåpan Pensioner pays the complementary retirement pension to you from the age of 65 and for five years, or for life if you so choose.

Individual retirement pension

Every month, your employer pays into a sum equivalent to 2.5 percent of your salary into an individual retirement pension fund. You choose yourself which insurer will manage your money. Your insurer will usually pay out your individual retirement pension from the age of 65, for the rest of your life. You can select repayment cover on this part, in which case the money will go to your spouse, partner or children if you die. If you do not choose who will manage your money, it will be placed in a traditional insurance scheme with repayment cover at Kåpan Pensioner.